Five Big Things to Know about MTD and CIS

How are the New MTD Rules Going to Affect CIS Subcontractors?

This is a summary of what you will learn about MTD and CIS

- You will need to register and buy a compatible software subscription.

- You will use an app (iPhone or Android) to send invoices, log receipts for purchases etc.

- Your banking transactions will upload automatically into your app.

- Your CIS will be automatically accounted for within the app.

- You will spend a few hours per month logging invoices and receipts, but less time at the end of the year when your personal tax return is due, this is because all the figures will be at hand.

Timelines

- MTD requirements starts;

- 6th April 2026 for people earning over £50,000 per year }

- 6th April 2027 for people earning over £50,000 per year } from self-employment or property, or self-employment and property.

- 6th April 2028 for people earning over £50,000 per year }

Essentials that you need to know

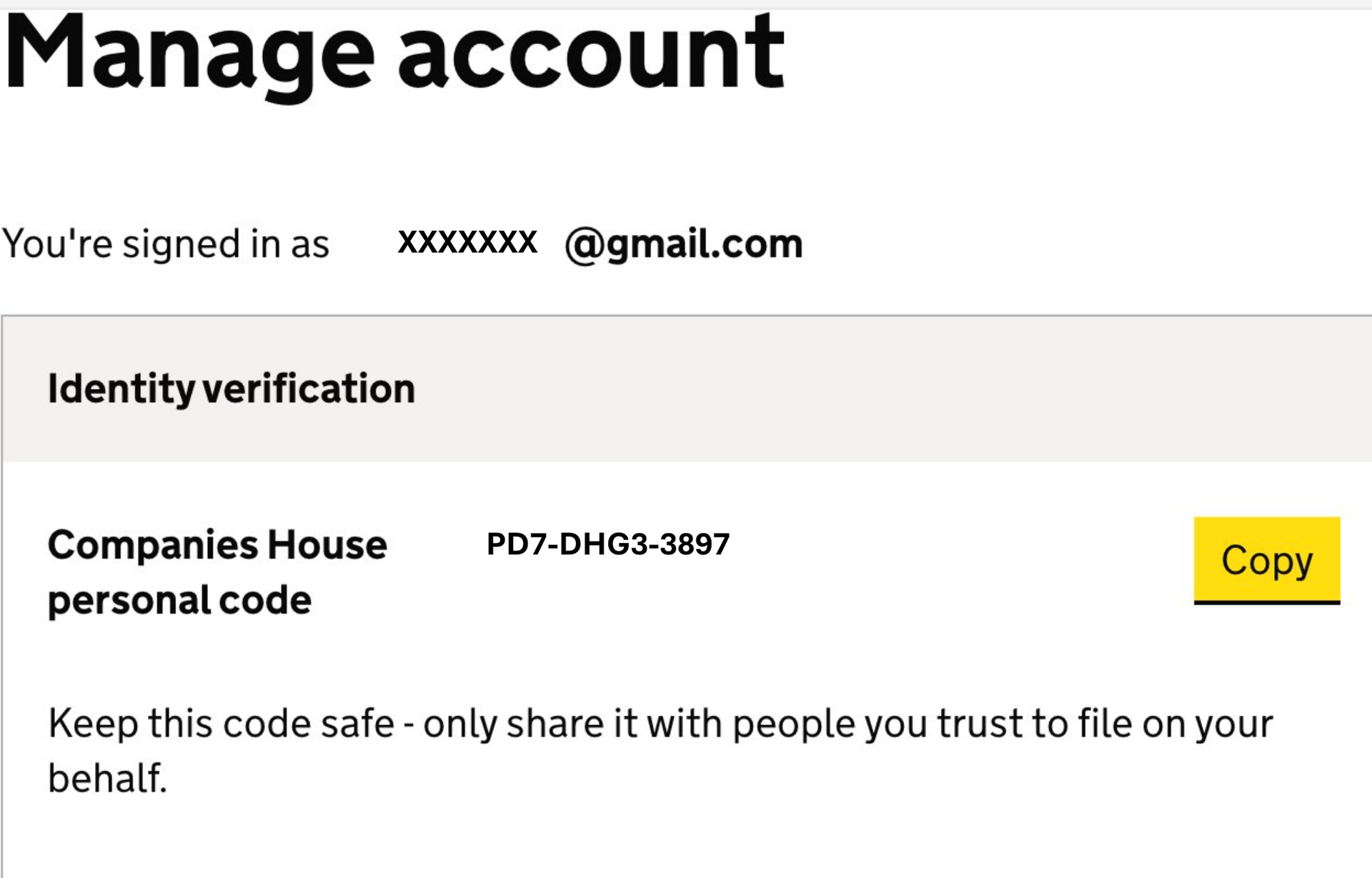

- You need to register your UTR with HMRC to submit returns under MTD before your due date.

- You need to subscribe to one of the many MTD compatible accounting softwares that are available.

- All compatible software comes in app form so you can manage MTD from your phone.

- Choose software that has been recommended by someone you trust.

- Using the software, your banking transactions will upload automatically and will recommend how to record each income or spend.

- You’ll enter use your email address to log in, and you will send your invoices from a template provided with the software by email.

- You will enter your UTR and the system will automatically account for CIS deductions depending on whether you have Gross Payment Status or the standard 20%.

- When you receive a payment, the system will treat an invoice as paid and record the CIS deduction suffered as an asset, which means amounts that are owed to you by HMRC.

- You must upload pdfs of the invoices you receive (if they are sent by email to you) otherwise a scanned image will do. Attaching a photo of your receipts taken from your phone is also possible..

- You attach a proof of purchase to the payment in your banking transactions by clicking on it in the app. This is essential; too many missing receipts will cause issues with HMRC.

Submitting returns under MTD

- You will need to submit a report to HMRC four times a year and these are compiled automatically within the app. You have a chance to check each one before submitting it. The app will prompt you to do this in good time.

- You will need to submit your annual personal tax return to HMRC as usual, this requirement doesn’t change.

- HMRC states that MTD will speed up tax rebates at the end of the year as MTD should make it much easier for HMRC to process CIS deductions- in theory.

Cost

You can manage MTD:- a, yourself, b, with someone checking the submissions to HMRC before you send them, or c, you can hand it over to an accountant.

For DIY MTD management it’s free, for a quarterly 'health-check' service before you submit a return, it’s £120 per year (£30 per quarterly report).

Accountants will charge between £300 and £500 per year. Book-keepers charge about £250 per year.

Your time is a cost factor but after the initial set up it should take less than an hour a week to complete necessary tasks, and then no time at all at the end of each year, because you will have all the figures/receipts for your annual personal tax return to hand.

Software

There are free apps that come with certain bank accounts, Mettle is one of them, but they are scaled down versions of a standard accounting package and may not suit everyone.

For £7 per month plus VAT you can subscribe to a simple version of a standard accounting package like Xero, which is missing no functionality. (There is no need for anything more expensive than this, because the full versions are designed for VAT registered businesses, or businesses that employ people and you won’t need any of these extra functionalities.)

CIS Payroll companies may provide access to some kind of a service, but in my opinion it is better to manage MTD/CIS independently.

Why not take a look at my other blog posts, they may not be specific to the construction industry, but they explain MTD in more detail.

Any questions??? Contact me the usual way or using this contact button -