Why is HMRC Pushing Small Business to go Digital?

What's behind the biggest overhaul in the UK tax system?

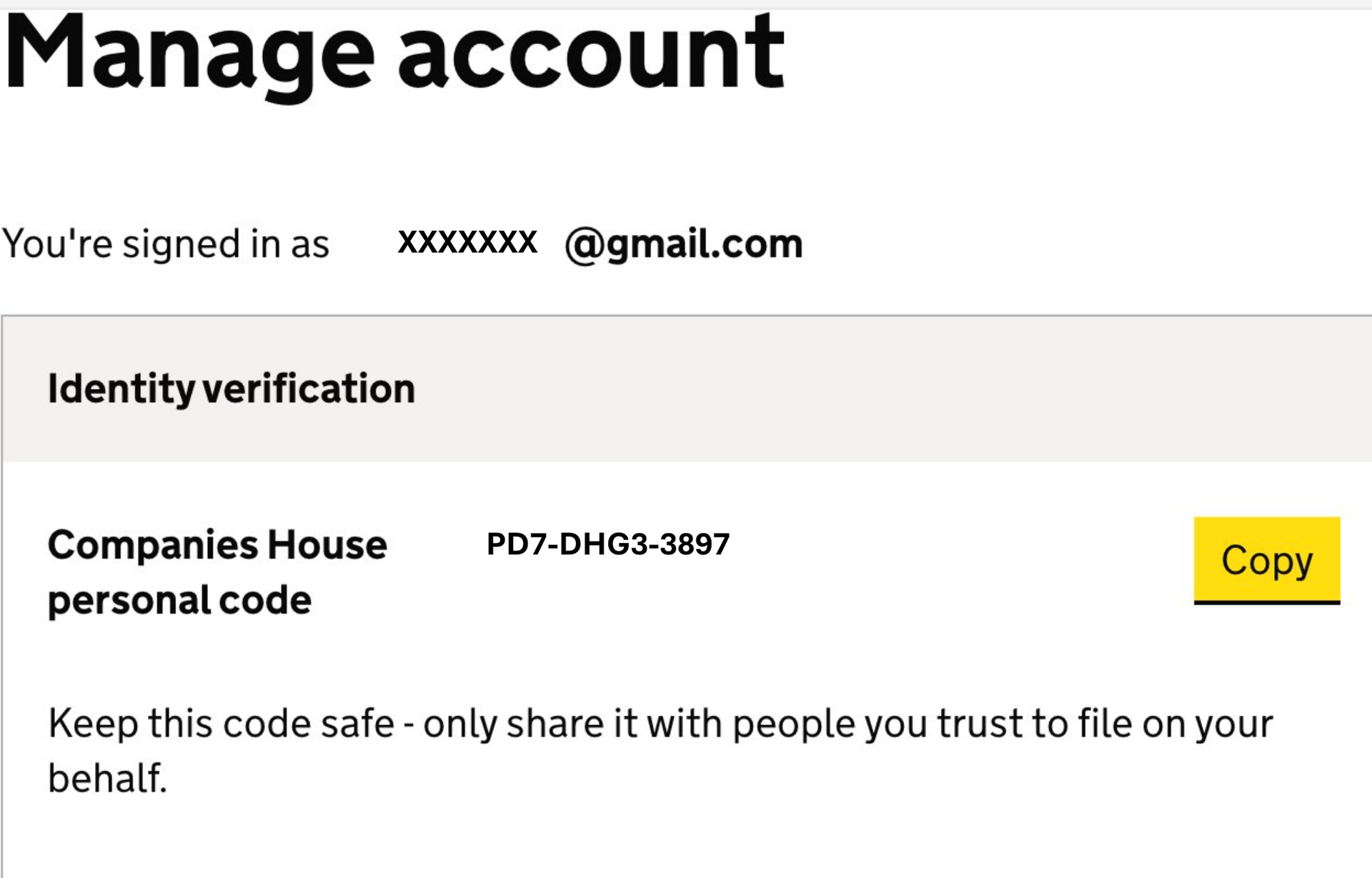

Why Is HMRC making most small business taxpayers adopt digital accounting?

Looking at it from HMRC's point of view, it makes sense, The UK tax gap for 2023–24 is estimated at £46.8 billion, which represents 5.3% of the tax that should theoretically be collected. That’s a huge shortfall—and HMRC’s latest data shows that small businesses account for around 60% of this gap, or roughly £28 billion.

Most of this gap comes from Corporation Tax, VAT, and self-employment business taxes. To put it in perspective, small company Corporation Tax alone makes up £14.7 billion, about half of the small business tax gap. The remainder is mainly split between VAT losses and undeclared or under-declared income from self-employment and property.

What’s Driving the Tax Gap?

HMRC breaks the tax gap down by behaviour, and small business non-compliance dominates several categories:

- Failure to take reasonable care: About 31% of the overall gap, often due to poor record-keeping and filing mistakes.

- Error: Around 15%, again concentrated among businesses with weak systems or limited understanding.

Combined, these two causes account for 46% of the gap, far outweighing deliberate tax evasion—which HMRC tackles through separate measures.

Why Digital?

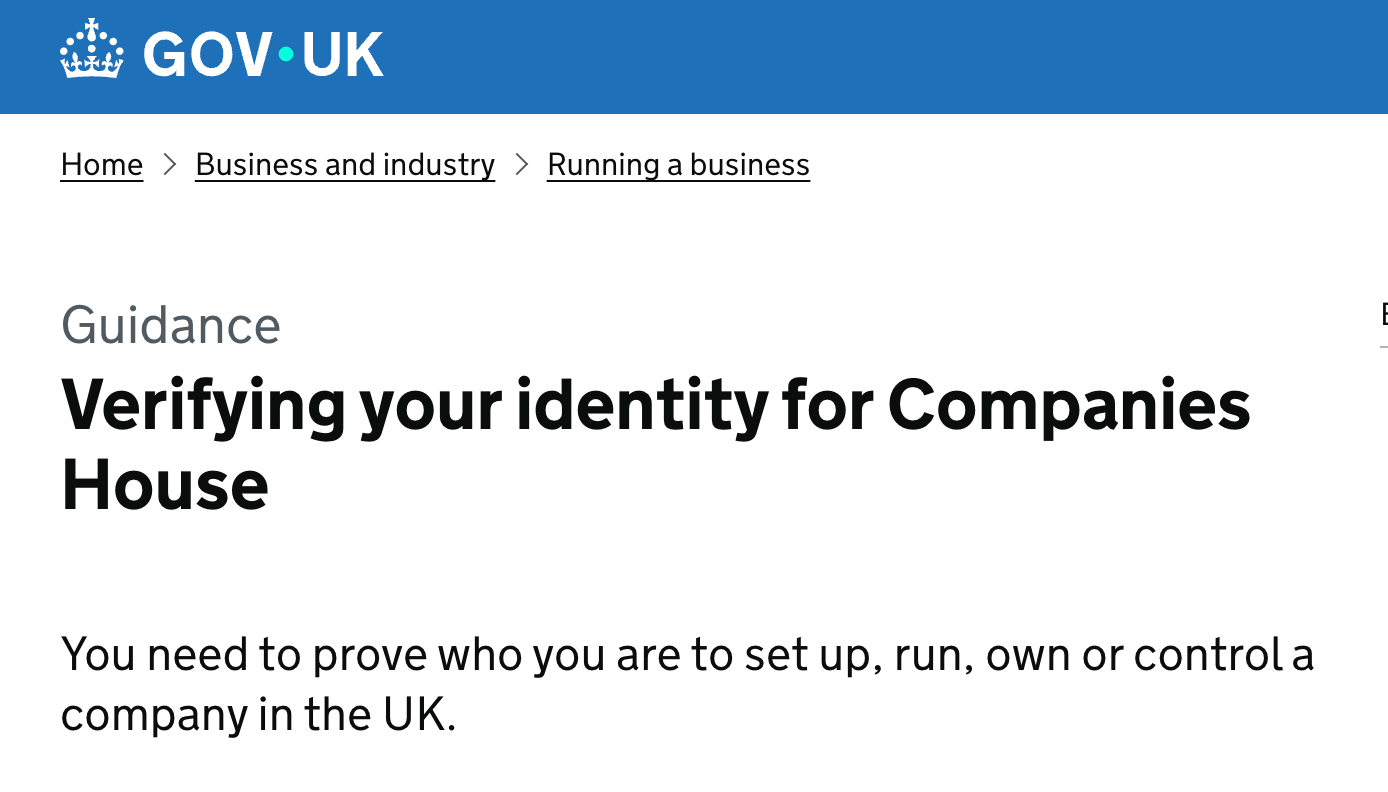

To close this gap, HMRC is extending Making Tax Digital (MTD) as it increases compliance by reducinig errors and providing real time tax information. HMRC is dead against people who don't ring fence tax money leaving them unable to pay their tax liabilities. Digitalisation enables taxpayers to take more control of their company finances, and allows HMRC to track exactly what they are doing through AI and other digital programmes.

For small companies, expect more targeted “nudge” messages when digital records, VAT returns, or Corporation Tax filings look inconsistent with sector norms or digital returns are lacking sufficient links to the company's receipts and invoices - A pdf or jpeg is a digital document, and is all it takes to keep accounts 'looking good' to HMRC.

How should small businesses prepare

Strong digital systems will be your best defence against enquiries and penalties. Here’s what to focus on:

- Maintain accurate digital records and reconcile VAT and bank data.

- Document VAT and payroll controls.

- Keep clear evidence for expense and relief claims.

For incorporated or limited companies, review these areas before year-end:

- Contractor relationships

- Director loan accounts

- Benefits and dividends

These steps will help ensure your Corporation Tax and PAYE positions stand up to the more intensive compliance activity expected from 2026/27.